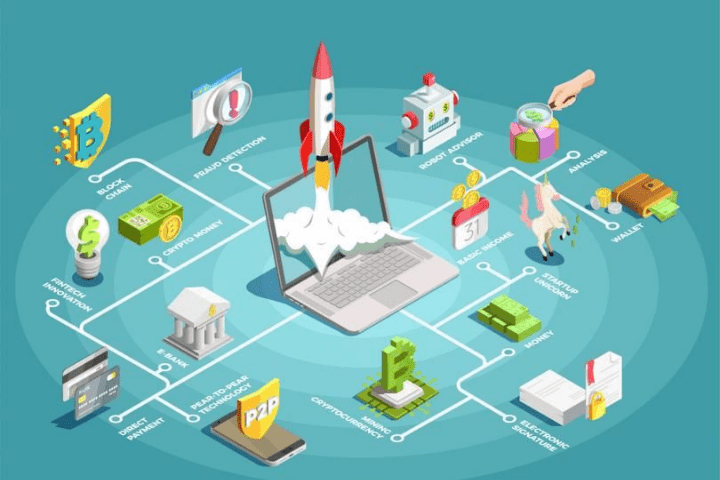

Fintech (Finance & Technology) refers to any firm that uses technology to improve or automate financial operations & services. The phrase refers to a rapidly growing industry that offers a diverse range of benefits to both individuals & organizations. These applications vary from simple insurance, banking to investment & cryptocurrency apps. The industry is large and will continue to grow for many years.

Each push factor is that more, and more financial institutions are early investors & followers of technology, vigorously making investments in, attaining, or colluding with these startups since it is extremely easy to provide those tech native clients desire while still thrusting the industry forth & remaining relevant.

A Global View Of The Fintech Industry

Fintech is not a new sector, it has just grown at a rapid pace. Whether it’s the advent of credit and debit cards as in the 1950s or ATMs, personal finance applications, automated trading platforms & greater trading in the subsequent decades, the sector has played a part in the banking world to some extent. The heart of financial technology differs based on the project and application. Furthermore, some of the most recent advancements use blockchain, machine learning algorithms & data science to handle activities that can range from credit risk assessments to hedge fund operations. Indeed, a type of regulation tool named “regtech” is presently available to aid businesses. Fintech firms must traverse the difficult world involving regulatory & compliance challenges.

Concerns about privacy in the fintech business have developed in tandem with the industry’s growth. Because of the tremendous global spread of fintech firms and markets, flaws in fintech technology have become more evident, leaving it a vulnerability for cybercriminal activity. However, technology is always evolving to reduce existing fraudulent risks & prevent new threats.

Applications Of Fintech Operations

Despite the industry’s hopes for entrepreneurs & game-changing technology, conventional businesses, and banks are continuously incorporating technology services into their operations. Here is another look at how the financial sector is being both disrupted and improved by the industry.

Banking

Mobile payment is a vital part of this sector. Consumers have increasingly demanded quick online/digital access to a bank, particularly via mobile devices, in the realm of personal finance. With the emergence of digital-first banks, or “Neobanks,” several financial companies now provide some form of mobile banking. Neobanks were simply organizations that do not have large branch locations & instead provide their clients with payment services, savings, checking, and loans through a completely digital infrastructure & mobile. To mention a few, neobanks are Chime, Simple, and Varo.

Cryptocurrencies & Blockchain Technology

Blockchain & Cryptocurrencies are rising with the rise of fintech. Blockchain technology enables the operation of cryptocurrency mining and markets, and advancements in cryptocurrency advanced technologies may be linked towards both blockchain & fintech. While cryptocurrency & blockchain are distinct technologies that will deem outside the scope of fintech, they are both required in principle to build practical applications that enhance fintech. Cryptocurrencies & Blockchain Technology Circle, Spring Labs & Gemini are examples of blockchain companies to keep an eye on, while SALT & Coinbase are examples of cryptocurrency companies to keep an eye on.

Savings & Investing

It will result in a rise in the population of investing & savings applications in recent years. Companies such as Acorns, Stash & Robinhood will intend than ever to invest. While their approaches differ, each app introduces individuals to markets by combining banking with regular small-dollar investment possibilities, such as quickly shaped donations on purchases.

Machine Learning & Trading

Forecasting market fluctuations is the Pinnacle of finance. Considering billions of dollars on the line, it’s no surprise as machine learning has grown more important in fintech. The strength of this AI subset is its ability to analyze massive amounts of data utilizing algorithms designed to offer customers, firms, spot trends, banks, dangers, as well as other entities with a more educated understanding of financial & buying concerns earlier.

Payments

Fintech is particularly good at money transmission. Venmo is a mobile payment platform. Payment processors have changed the way we all do business. It is now easier than ever to transmit payments digitally over the world. In addition to Venmo, popular payment providers include Paypal, Stripe, Zelle & Square.

Lending

Fintech is also changing lending by automated risk assessment, speeding up approval processes & providing loans more accessible. Millions of individuals across the world also may apply for a mortgage via their smart devices, risk modeling capabilities & new data points are increasing lending to various populations. Furthermore, anybody may obtain credit payment history several times each year without negatively impacting his\her credit score, turning the actual financial landscape quite transparent for everyone. Three well-known credit firms include Petal, Tala and Credit Karma.

Insurance

While Insurance tech is evolving into its own business, it is still regarded as fintech. Health coverage has been a late adopter of technology, and some fintech firms are collaborating with regular insurance businesses to help improve operations and increase coverage. From smartphone insurance coverage to health insurance wearables, the sector is witnessing a lot of innovation. Insurance tech startups to watch include Oscar Health, Root Insurance & Policy Genius.

Frequently Asked Questions Regarding Fintech

What Precisely Does The Term “Fintech” Mean?

Fintech stands for “financial technology,” but this relates to the use of new technological developments towards financial services & goods. A specialist will describe what & how it operates. So read more about this in this post.

What Is A Fintech Payment Solution Exactly?

Fintech organizations use cutting-edge technologies (like data science, artificial intelligence & blockchain) to make conventional financial sectors safer, faster, and more efficient. Fintech is among the fastest-growing digital industries, with firms innovating in nearly every element of finance, from transactions & lending to credit assessment, and stock trading.

What Are The Fintech Trends For 2024?

Fintech is a fast-growing industry with nearly endless potential to improve our financial systems. Some of the Fintech breakthroughs we will see in 2024 include the rise of Robo-advisors in trading stocks, through the use of blockchain technology in anti-money laundering efforts, the process of integration credit agencies & the de-centralize of global payments.

Also Read: Innovative Fintech Companies Are Reshaping The Financial Industry